Invest in 5G Network (with Stock Picks)

In near future, 5G networks will bring faster, less latency, and higher coverage to wireless consumers across the United States (actually across the world). In Dec 2017, the 3rd Generation Partnership Project (3GPP), has approved the first 5G network standards six months ahead of schedule. 3GPP is expected to publish the specifications soon that will enable companies to start building 5G equipment.

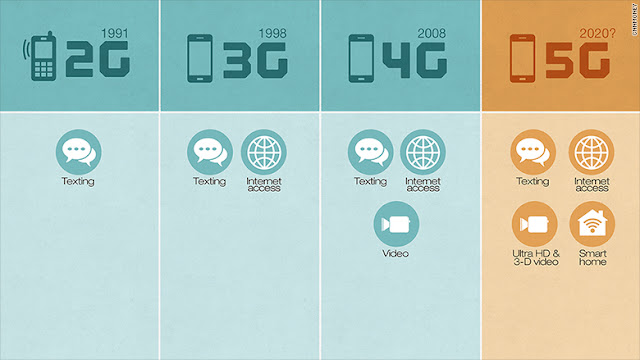

5G is shorthand for the fifth generation of mobile networks. It will be the next wireless standard implemented beyond the current 4G protocol. The benefits will be immense and immediately recognizable. Data rates for 5G are expected to be 10~100 times faster than 4G and LTE systems, with download speeds up to 10 Gbps.

5G has dominated this year's Mobile World Congress (MWC) in Barcelona. Huawei announced its first 5G chip, which will allow the company's mobile devices to access the next generation of cellular networks.

In this article, I would like to pick a few possible big winners in 5G Era.

Currently T @ $36.35, with 5.5% dividend yield, VZ @ $48.26 with 4.9% dividend yield. At this moment, it is hard to tell which one is better.

Currently AMT @ $140, with 2,1% dividend yield.

Boingo Wireless acquires long-term wireless rights at venues, such as airports, transportation hubs, stadiums, arenas, universities, convention centers and office campuses, and it builds wireless networks, such as DAS, Wi-Fi and small cells, at those venues and monetizes the wireless networks through a range of products and services. As of December 31, 2016, the company operated 36 DAS networks containing approximately 19,200 DAS nodes. Its Wi-Fi network includes locations that the company manages and operates, as well as networks managed and operated by third-parties with whom it contracts for access.

Currently WIFI @ $25.97. It has performed quite well in recent correction.

The company provides colocation services and related offerings, including operations space, storage space, cabinets and power for customers colocation needs; interconnection services, comprising physical cross connect/direct interconnections, Equinix Internet Exchange, Equinix Cloud Exchange, Equinix Metro Connect and Internet connectivity services; and managed IT infrastructure services, including installation of customer equipment and cabling, as well as equipment rebooting and power cycling, card swapping and emergency equipment replacement services.

Currently EQIX @ $381.82, with 2.4% dividend yield.

The company also offers 45 carrier-neutral data center facilities across the United States and France. Zayo was the first to offer bandwidth shopping and buying in under two minutes through Tranzact.

Currently ZAYO @ $36.01.

Currently SWKS @ $109.14, with 1.2% dividend yield.

Currently GLW @ $28.8, with 2.5% dividend yield.

5G is shorthand for the fifth generation of mobile networks. It will be the next wireless standard implemented beyond the current 4G protocol. The benefits will be immense and immediately recognizable. Data rates for 5G are expected to be 10~100 times faster than 4G and LTE systems, with download speeds up to 10 Gbps.

5G has dominated this year's Mobile World Congress (MWC) in Barcelona. Huawei announced its first 5G chip, which will allow the company's mobile devices to access the next generation of cellular networks.

In this article, I would like to pick a few possible big winners in 5G Era.

Leading Carriers: Verizon (VZ) and AT&T (T)

AT&T has said it will have mobile 5G available in a dozen markets, including Atlanta and Dallas, later this year. Verizon CTO said his company would be first in mobile 5G services, but gave few other details. The company is also deploying 5G as a fixed service intended to replace your home internet connection, starting with Sacramento, California. T-Mobile and Sprint are setting things up now for a commercial launch early next year. Handset makers and chipmakers are working to get devices ready for 2019 as well.Currently T @ $36.35, with 5.5% dividend yield, VZ @ $48.26 with 4.9% dividend yield. At this moment, it is hard to tell which one is better.

American Tower (AMT)

This wireless tower company is also an industry leader --- the largest global owner and operator of wireless and broadcast communications towers. Its portfolio includes approximately 140,000 sites in the United States, Latin America, India, Europe and Africa. The core business for the company is leasing space on its wireless towers, primarily to wireless carriers, government agencies and broadband data providers.Currently AMT @ $140, with 2,1% dividend yield.

Boingo Wireless (WIFI)

Boingo Wireless Inc. is a provider of commercial mobile wireless fidelity (Wi-Fi) internet solutions and indoor direct-attached storage (DAS) services. The company operates as a service provider of wireless connectivity solutions across its managed and operated network and aggregated network for mobile devices such as laptops, smartphones, tablets and other wireless-enabled consumer devices.Boingo Wireless acquires long-term wireless rights at venues, such as airports, transportation hubs, stadiums, arenas, universities, convention centers and office campuses, and it builds wireless networks, such as DAS, Wi-Fi and small cells, at those venues and monetizes the wireless networks through a range of products and services. As of December 31, 2016, the company operated 36 DAS networks containing approximately 19,200 DAS nodes. Its Wi-Fi network includes locations that the company manages and operates, as well as networks managed and operated by third-parties with whom it contracts for access.

Currently WIFI @ $25.97. It has performed quite well in recent correction.

Equinix (EQIX)

This is one of the larger capitalization companies in the data center industry. Equinix Inc. (NASDAQ: EQIX) provides data center services to protect and connect the information assets for the enterprises, financial services companies, and content and network providers primarily in the Americas, Europe, the Middle East, Africa and the Asia-Pacific.The company provides colocation services and related offerings, including operations space, storage space, cabinets and power for customers colocation needs; interconnection services, comprising physical cross connect/direct interconnections, Equinix Internet Exchange, Equinix Cloud Exchange, Equinix Metro Connect and Internet connectivity services; and managed IT infrastructure services, including installation of customer equipment and cabling, as well as equipment rebooting and power cycling, card swapping and emergency equipment replacement services.

Currently EQIX @ $381.82, with 2.4% dividend yield.

Zayo Group (ZAYO)

Zayo Group Holdings Inc. provides comprehensive bandwidth infrastructure services in over 300 markets throughout the United States and Europe. Zayo delivers a suite of dark fiber, mobile infrastructure and cloud and connectivity services to wireline and wireless customers, data centers, internet content providers, high-bandwidth enterprises and government agencies across its robust 82,000 route mile network.The company also offers 45 carrier-neutral data center facilities across the United States and France. Zayo was the first to offer bandwidth shopping and buying in under two minutes through Tranzact.

Currently ZAYO @ $36.01.

Skyworks Solutions (SWKS)

Skyworks has been labeled as Apple supplier. However, it is not the whole story. Precise filtering is increasingly important in wireless communications. Skyworks is one of the largest manufacturers of TC-SAW filters, which stands for temperature-compensated-surface acoustic wave filters. This is a quality, low-cost alternative to the more expensive BAW (bulk acoustic wave) filters, which some of Skyworks' competitors make.Currently SWKS @ $109.14, with 1.2% dividend yield.

Corning Inc (GLW)

It has been almost 50 years since Corning Inc invented the first low-loss optical fiber that could transmit data as light. Since that historic day in 1970, optical fiber has become the backbone of network infrastructure. While Corning is probably best known for outfitting LCD televisions with glass screens (Gorrila), its second-largest division is still manufacturing optical fiber.Currently GLW @ $28.8, with 2.5% dividend yield.

Comments

Post a Comment