Market 2018-01-23 (NFLX, AAPL, FSLR, and more)

Market shows strength again, led by Tech (QQQ +0.8%) and Utilities. Yes, fix-income bounces back (XLU +1%, IYR +1.3%).

Crude +1.89% to $64.77. Gold +0.66% to $1,340.70.

Axios publishes what it says is a draft copy (6 pages) of the Trump administration's infrastructure plan; it contains no specific dollar amounts for any of the initiatives. According to the leaked document, half of appropriations would go toward an incentives program giving federal grants to state, local or private entities; grant awards can cover up to 20% of the total cost of the infrastructure plan. 10% of the plan's funds would go to "Transformative Projects Program," in which the federal government would pay for as much as 80% of capital construction costs, 30% of demonstration trials and 50% of post-demonstration planning costs. The impact is unclear at this point.

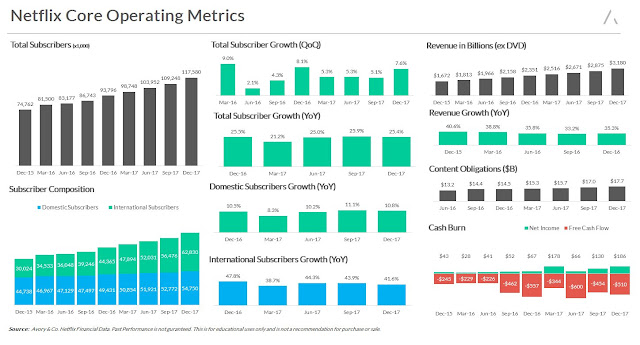

NFLX (+10%) share price jumps to new-high as market-cap passes $100B. Bears point out the quick cash-burn, $2B in 2017 and possible $4B in 2018. All the data in recent quarters are shown in one chart below. (click to see in large) Bulls argue that the cash-burn is not "really burned". The original contents will stay on Netflix forever. As comparison, Disney (DIS -0.6%) has market-cap of $167B, who owns decades of contents (also including Marvel, Lucasfilm), ABC/Dsiney chanel, ESPN, parks&resorts, cruise...

Apple (AAPL flat) shipped 29M iPhone X units in CY17 Q4 (Apple’s Q1 FY18), according to Canalys estimates, and 7M were shipped in China. JPMorgan sees more signs of weakening iPhone X sales and forecasts build to be down 50% on the quarter. Also on news, Apple finally shows its Homepod today, which is kind of disappointing.

Other FAANG members: FB +2.2%, AMZN +2.7%, GOOG +1.2%. Also other hot Techs: NVDA +2.2%, MU +2.5%, WDC +1.3%, INTC +0.7%, IBM +2.5%, BABA +4.5%...

Adobe Systems (ADBE +1.1%) lifts its FY18 EPS guidance to $6.20 from the prior forecast of $5.50. Adobe cites the recent U.S. tax laws since the company expects its effective tax rate to “substantially” decline.

LOGI (+10.9%) Q3 EPS of $0.65 beats by $0.07. Revenue of $812.02M (+21.8% Y/Y) beats by $57.89M. Raised FY18 guidance has revenues up 12% to 14% on the year to $2.47B to $2.5B (consensus: $2.46B; was: $2.43B to $2.47B). Logitech expects operating income between $270M and $280M (was: $260M to $270M.)

Whirlpool (WHR +3.2%) flies as new tariffs on imported washing machines start at 20% and are imposed over three years, starting at 20% for the first 1.2M units of imported finished washers and 50% of all subsequent imports on year one.

MAT (+10.4%) spikes in the afternoon, amid buyout rumor (again). HAS +4.1%. If they do have a deal, I believe MAT will be priced around $24/share. It finishes @ $17.8 today. However, it is not a sure thing as the rumor has hung around for quite a while now.

CELG (+1.6%) bounces back, IBB (+1.1%) continues the rally.

GE (+4.5%) receives a Neutral rating and $17 PT from UBS, who also gives UTX buy rating with $158 PT, and SWK buy rating with $200 PT.

ChinaNet Online Holdings (CNET +9%) jumps as the company announces a new joint venture around blockchain technology.

KMB +0.8%, Q4 EPS of $1.57 beats by $0.02. Revenue of $4.58B (+0.9% Y/Y) misses by $20M. It sets a four-year cost savings target of more than $1.5B. The company plans to cut 5,000-plus jobs and 10 facilities. I believe some jobs will be replaced by robots, as I discussed in an earlier article "Invest in Artificial Intelligence".

JNJ -4.2% despite the company reported Q4 EPS of $1.74 beats by $0.02. Revenue of $20.2B (+11.5% Y/Y) beats by $130M. 2018 Guidance: Revenues: $80.6-81.4B; Non-GAAP EPS: $8.00 - $8.20.

PG -3.1% after reporting Q2 EPS of $1.19 beats by $0.05. Revenue of $17.4B (+3.2% Y/Y) in-line. The company expects EPS growth of 5-8% this year vs. 5-7% prior forecast.

VZ -0.4% after reporting Q4 EPS of $0.86 misses by $0.02. Revenue of $33.96B (+5.0% Y/Y) beats by $700M. CMCSA -1.1%, T -1.8%.

EDU -8.9% after ER miss: Q2 EPS of $0.09 misses by $0.02. Revenue of $467.2M (+36.9% Y/Y) beats by $11.16M.

GNC -5.8% cools down after recent bounce.

TXN (+0.5%) Q4 EPS of $1.09 in-line. Revenue of $3.75B (+10.0% Y/Y) beats by $10M. Shares -5% AH.

CREE (-4.6%) Q2 EPS of -$0.01 misses by $0.02. Revenue of $367.87M (+6.0% Y/Y) beats by $18.25M. Shares -0.7% in light volume.

Sold 1/3 TIS @ $15.6. I reduce my position after a nice run recently, YTD +22%.

Sold 1/4 OHI @ $27.5. My REIT is overweight now (O, OHI & MAA total ~20% in portfolio), start to trim my exposure as I am afraid Treasury yields may go higher.

Bought PG @ $88.7.

Crude +1.89% to $64.77. Gold +0.66% to $1,340.70.

Axios publishes what it says is a draft copy (6 pages) of the Trump administration's infrastructure plan; it contains no specific dollar amounts for any of the initiatives. According to the leaked document, half of appropriations would go toward an incentives program giving federal grants to state, local or private entities; grant awards can cover up to 20% of the total cost of the infrastructure plan. 10% of the plan's funds would go to "Transformative Projects Program," in which the federal government would pay for as much as 80% of capital construction costs, 30% of demonstration trials and 50% of post-demonstration planning costs. The impact is unclear at this point.

Winners

NFLX (+10%) share price jumps to new-high as market-cap passes $100B. Bears point out the quick cash-burn, $2B in 2017 and possible $4B in 2018. All the data in recent quarters are shown in one chart below. (click to see in large) Bulls argue that the cash-burn is not "really burned". The original contents will stay on Netflix forever. As comparison, Disney (DIS -0.6%) has market-cap of $167B, who owns decades of contents (also including Marvel, Lucasfilm), ABC/Dsiney chanel, ESPN, parks&resorts, cruise...Apple (AAPL flat) shipped 29M iPhone X units in CY17 Q4 (Apple’s Q1 FY18), according to Canalys estimates, and 7M were shipped in China. JPMorgan sees more signs of weakening iPhone X sales and forecasts build to be down 50% on the quarter. Also on news, Apple finally shows its Homepod today, which is kind of disappointing.

Other FAANG members: FB +2.2%, AMZN +2.7%, GOOG +1.2%. Also other hot Techs: NVDA +2.2%, MU +2.5%, WDC +1.3%, INTC +0.7%, IBM +2.5%, BABA +4.5%...

Adobe Systems (ADBE +1.1%) lifts its FY18 EPS guidance to $6.20 from the prior forecast of $5.50. Adobe cites the recent U.S. tax laws since the company expects its effective tax rate to “substantially” decline.

LOGI (+10.9%) Q3 EPS of $0.65 beats by $0.07. Revenue of $812.02M (+21.8% Y/Y) beats by $57.89M. Raised FY18 guidance has revenues up 12% to 14% on the year to $2.47B to $2.5B (consensus: $2.46B; was: $2.43B to $2.47B). Logitech expects operating income between $270M and $280M (was: $260M to $270M.)

Whirlpool (WHR +3.2%) flies as new tariffs on imported washing machines start at 20% and are imposed over three years, starting at 20% for the first 1.2M units of imported finished washers and 50% of all subsequent imports on year one.

MAT (+10.4%) spikes in the afternoon, amid buyout rumor (again). HAS +4.1%. If they do have a deal, I believe MAT will be priced around $24/share. It finishes @ $17.8 today. However, it is not a sure thing as the rumor has hung around for quite a while now.

CELG (+1.6%) bounces back, IBB (+1.1%) continues the rally.

GE (+4.5%) receives a Neutral rating and $17 PT from UBS, who also gives UTX buy rating with $158 PT, and SWK buy rating with $200 PT.

ChinaNet Online Holdings (CNET +9%) jumps as the company announces a new joint venture around blockchain technology.

KMB +0.8%, Q4 EPS of $1.57 beats by $0.02. Revenue of $4.58B (+0.9% Y/Y) misses by $20M. It sets a four-year cost savings target of more than $1.5B. The company plans to cut 5,000-plus jobs and 10 facilities. I believe some jobs will be replaced by robots, as I discussed in an earlier article "Invest in Artificial Intelligence".

Losers

First Solar (FSLR -0.7%) gave up all the early big gain following the Trump administration's approval of tariffs as high as 30% on imported solar panels. The solar tariffs would last for four years and decline in increments of 5% from 30% at the start to 15% in the final year. This tariffs will benefit US solar manufactures (might be priced in already), but not installation companies (higher price, less business). The solar industry may lose thousands of jobs. It is estimated a loss of 23k jobs this year out of total 374k workforce, more than 6%.JNJ -4.2% despite the company reported Q4 EPS of $1.74 beats by $0.02. Revenue of $20.2B (+11.5% Y/Y) beats by $130M. 2018 Guidance: Revenues: $80.6-81.4B; Non-GAAP EPS: $8.00 - $8.20.

PG -3.1% after reporting Q2 EPS of $1.19 beats by $0.05. Revenue of $17.4B (+3.2% Y/Y) in-line. The company expects EPS growth of 5-8% this year vs. 5-7% prior forecast.

VZ -0.4% after reporting Q4 EPS of $0.86 misses by $0.02. Revenue of $33.96B (+5.0% Y/Y) beats by $700M. CMCSA -1.1%, T -1.8%.

EDU -8.9% after ER miss: Q2 EPS of $0.09 misses by $0.02. Revenue of $467.2M (+36.9% Y/Y) beats by $11.16M.

GNC -5.8% cools down after recent bounce.

AH Earnings

UAL (+1.4%) Q4 EPS of $1.40 beats by $0.06. Revenue of $9.44B (+4.3% Y/Y) beats by $20M. Shares +2% AH.TXN (+0.5%) Q4 EPS of $1.09 in-line. Revenue of $3.75B (+10.0% Y/Y) beats by $10M. Shares -5% AH.

CREE (-4.6%) Q2 EPS of -$0.01 misses by $0.02. Revenue of $367.87M (+6.0% Y/Y) beats by $18.25M. Shares -0.7% in light volume.

My Trades Today

Sold QD @ $13.2. One of my favorite day-trade candidates.Sold 1/3 TIS @ $15.6. I reduce my position after a nice run recently, YTD +22%.

Sold 1/4 OHI @ $27.5. My REIT is overweight now (O, OHI & MAA total ~20% in portfolio), start to trim my exposure as I am afraid Treasury yields may go higher.

Bought PG @ $88.7.

Comments

Post a Comment