A Close Look of WDC & STX (also MU, INTC)

After reaching mutual agreement with Toshiba, WDC updated its guidance on 12/13: Q2 guidance has revenue of $5.3B (consensus: $5.28B, was: $5.2~5.3B) and EPS at $3.80 (consensus: $3.67, was: $3.60~3.80).

FY18 guidance has EPS over $13 (consensus: $13.18) and revenue at the high end of 4% to 8% growth or about $20.6B (consensus: $20.34B). As comparison, EPS in FY17 is $8.80. Current price is $81.62. Forward P/E = 6.2. Dividend yield 2.5%.

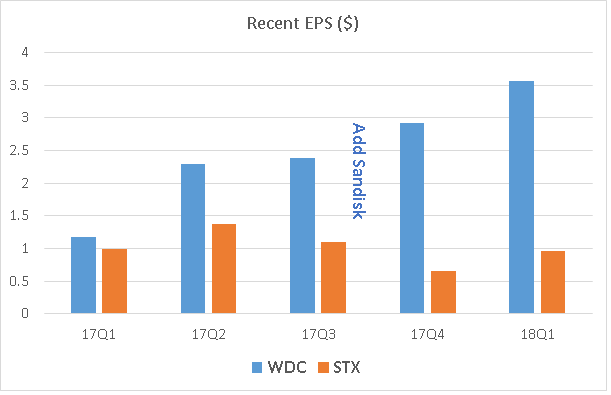

On Wall Street, WDC is considered in the category of Tech-Semiconductor-Hardware-Storage. The closest pal is Seagate. Let's have a comparison between WDC and STX. STX FY17 EPS is $4.12. Current price is $42.02. Dividend yield 6%. The head-to-head EPS in recent quarters is shown in the chart below.

On 5/12/2016, WDC announced that it has completed the acquisition of SanDisk Corporation ($19B). The addition of SanDisk makes WDC a comprehensive storage solutions provider with global reach, and an extensive product and technology platform that includes deep expertise in both rotating magnetic storage and non-volatile memory (NVM).

On the other hand, on 7/25/2016, Seagate announced Steve Luczo will be stepping down as CEO after more than eight years on the job, albeit while remaining chairman, and that it's cutting another 600 jobs six months after unveiling plans to cut over 2,000 jobs by shuttering a Chinese plant. President/COO Dave Mosley will be Seagate's new CEO as of 10/1.

On 12/11, STX plans to reduce its global headcount by approximately 500 employees. The cuts will be substantially completed by the end of FY18. Their next step will be to shrink dividend as HDD is replaced by SSD.

Solid state drives (SSDs) are displacing hard disk drives (HDDs) in not only personal computers, but also corporate data centers at an accelerating rate.

Durability and Reliability

Overall, experience has shown that high-end HDDs (4TB+) have a failure rate of about 3.5 percent during the expected life of the drive, compared to a SSD failure rate of about 0.3 percent.

At this point SSDs and HDDs seem to have roughly equivalent longevity. Testing by Backblaze indicates that the median lifespan of a hard drive is over six years, while SSD life expectancy is in the range of five to seven years.

Samsung is the elephant in the room. WDC takes No.2 seat, about double size of Intel, who is the 3rd. Seagate is well behind. The fast growing space allow so many players to have a bite. It is very possible that WDC or Intel to take over some small players in the next few years.

WDC has also big market share in flash memory market. WDC and Toshiba together have 35% market share, well ahead of Micron or SK Hynix.

SanDisk had been a long-term partner of Toshiba since 2001, and the joint venture had provided SanDisk with stable NAND supply. The two companies collaborated in developing BiCS3, which they claim was "the world's first 3D NAND technology with 64 layers.

Western Digital and Toshiba currently operate several fabs under three business ventures in 300-mm NAND-flash manufacturing facilities, which provide leading-edge, cost-competitive NAND wafers for end products.

Flash Partners Ltd., which operates primarily in Toshiba's Fab 3 facility, was formed in September 2004.

Flash Alliance Ltd., which operates primarily in Toshiba's Fab 4 facility, was formed in July 2006.

Flash Forward Ltd., which operates primarily in Toshiba's Fab 5 facility, was formed in July 2010.

In mid-July 2016, Toshiba and Western Digital opened the New Fab 2 in Yokkaichi, Japan. Construction of New Fab 2 had begun in September 2014.

WDC is a 49.9% owner in Flash Ventures, the moniker for the three business ventures as well as the New Fab 2.

In early November 2016, Toshiba finalized plans to build a new production facility to make 3D NAND --- Fab 6. This is the key factor in their recent settlement. "TMC and Western Digital will participate jointly in future investments in Fab 6, now under construction, including the round announced in October. The companies also plan to enter into agreements for Western Digital’s participation in the new flash wafer fab planned for Iwate, Japan."

FY18 guidance has EPS over $13 (consensus: $13.18) and revenue at the high end of 4% to 8% growth or about $20.6B (consensus: $20.34B). As comparison, EPS in FY17 is $8.80. Current price is $81.62. Forward P/E = 6.2. Dividend yield 2.5%.

On Wall Street, WDC is considered in the category of Tech-Semiconductor-Hardware-Storage. The closest pal is Seagate. Let's have a comparison between WDC and STX. STX FY17 EPS is $4.12. Current price is $42.02. Dividend yield 6%. The head-to-head EPS in recent quarters is shown in the chart below.

On 5/12/2016, WDC announced that it has completed the acquisition of SanDisk Corporation ($19B). The addition of SanDisk makes WDC a comprehensive storage solutions provider with global reach, and an extensive product and technology platform that includes deep expertise in both rotating magnetic storage and non-volatile memory (NVM).

On the other hand, on 7/25/2016, Seagate announced Steve Luczo will be stepping down as CEO after more than eight years on the job, albeit while remaining chairman, and that it's cutting another 600 jobs six months after unveiling plans to cut over 2,000 jobs by shuttering a Chinese plant. President/COO Dave Mosley will be Seagate's new CEO as of 10/1.

On 12/11, STX plans to reduce its global headcount by approximately 500 employees. The cuts will be substantially completed by the end of FY18. Their next step will be to shrink dividend as HDD is replaced by SSD.

SSD Vs HDD

Solid state drives (SSDs) are displacing hard disk drives (HDDs) in not only personal computers, but also corporate data centers at an accelerating rate.Performance

In the random 4k write test the HDD achieved a rate of just under 208 IOPS, while the SSD came in at almost 30,000 IOPS. In general, SSDs can achieve a performance level that is up to three orders of magnitude faster than HDDs.Cost Per TB

At this point storage arrays that incorporate commodity HDDs still have a price advantage over SSD arrays for workloads that are not performance-intensive. But SSD prices continue to fall at a rapid rate.Durability and Reliability

Overall, experience has shown that high-end HDDs (4TB+) have a failure rate of about 3.5 percent during the expected life of the drive, compared to a SSD failure rate of about 0.3 percent.

At this point SSDs and HDDs seem to have roughly equivalent longevity. Testing by Backblaze indicates that the median lifespan of a hard drive is over six years, while SSD life expectancy is in the range of five to seven years.

Energy Cost

Each HDD directly consumes about five times as much electricity as does an equivalent SSD.The Trend

The trend is shown in the following chart. HDD is shrinking, which exactly is what hurt STX. SSD is growing rapidly and steadily. Overall market is growing 3-5% per year.What is WDC/STX position in HDD/SSD?

HDD Market Shares

Three players: 1. WDC, 2. STX, 3. Toshiba. WDC has the highest market share. They will maintain this way.

SSD Market Shares

Samsung is the elephant in the room. WDC takes No.2 seat, about double size of Intel, who is the 3rd. Seagate is well behind. The fast growing space allow so many players to have a bite. It is very possible that WDC or Intel to take over some small players in the next few years.

What is Other Business of WDC?

WDC has also big market share in flash memory market. WDC and Toshiba together have 35% market share, well ahead of Micron or SK Hynix.SanDisk had been a long-term partner of Toshiba since 2001, and the joint venture had provided SanDisk with stable NAND supply. The two companies collaborated in developing BiCS3, which they claim was "the world's first 3D NAND technology with 64 layers.

Western Digital and Toshiba currently operate several fabs under three business ventures in 300-mm NAND-flash manufacturing facilities, which provide leading-edge, cost-competitive NAND wafers for end products.

Flash Partners Ltd., which operates primarily in Toshiba's Fab 3 facility, was formed in September 2004.

Flash Alliance Ltd., which operates primarily in Toshiba's Fab 4 facility, was formed in July 2006.

Flash Forward Ltd., which operates primarily in Toshiba's Fab 5 facility, was formed in July 2010.

In mid-July 2016, Toshiba and Western Digital opened the New Fab 2 in Yokkaichi, Japan. Construction of New Fab 2 had begun in September 2014.

WDC is a 49.9% owner in Flash Ventures, the moniker for the three business ventures as well as the New Fab 2.

In early November 2016, Toshiba finalized plans to build a new production facility to make 3D NAND --- Fab 6. This is the key factor in their recent settlement. "TMC and Western Digital will participate jointly in future investments in Fab 6, now under construction, including the round announced in October. The companies also plan to enter into agreements for Western Digital’s participation in the new flash wafer fab planned for Iwate, Japan."

I might be crazy but I'm confused about the last sentence: according to google, the current P/E of WDC is 17.45?

ReplyDeleteDon't trust google. FY18 guidance has EPS over $13 (consensus: $13.18). As comparison, EPS in FY17 is $8.80. Current price is $81.62. Forward P/E = 6.2.

Delete