Market 2017-11-3 (AAPL, SBUX, GE, and more)

Market is boosted by Apple earnings, all three indexes finish green, leading by tech and healthcare.

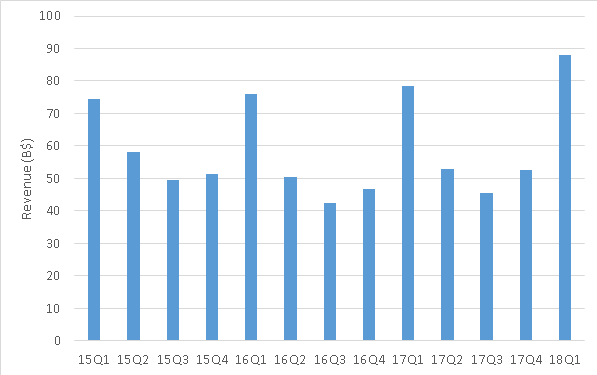

Major news: Trump starts his long Asian trip.

AAPL (+2.6%) reported surprising ER beat and bright outlook of iphone X. I would like to share some data and my thoughts. 2018Q1 and Q2 will probably great. P/E is standing @ 19 now. The following chart is the revenue data in the recent years. It took a dip in 2016 and recovered in 2017 --- $234B in 2015, $216B in 2016 and $229B in 2017, which means revenue dropped 2% from 2015 to 2017. On 1/1/2015, stock price was $109, it is $173 today. The huge factor will be iphone sale in China and the innovations beyond iphone X. If they cannot deliver, I believe the revenue will start to shrink again from 2018Q3.

SBUX (+2.1%) stock price dropped more than 7% yesterday after the ER due to the flat revenue and long-term growth rate cut from 15-20% to 12%. Analysts later realized it is one week short compared to last year, which means revenue grows 7% indeed. And 12% growth is not bad at all, on which CEO shows his confidence to achieve.

UAL (+2.4%) beaten-down airlines finally has a good day, no specific news.

GE (+1%) finally stops 9-day bleeding and find the support @ $20. Melius Research's Scott Davis believes GE CEO John Flannery likely will take even more drastic action than previously indicated, including a "spinoff its troubled Power unit and refocus that unit away from growth and more towards annuitized cash generation." Davis thinks GE's renewable business could find a home elsewhere, GECAS will be spun off, and smaller and non-core pieces also will be sold off, including Transportation (locomotives) and the Healthcare IT business. "Essentially what would remain of GE then would be a world-class healthcare asset, which Flannery knows very well, a majority equity stake in BakerHughes, and a world-class aerospace business," Davis writes. Even so, Davis is optimistic about GE in the long term, reiterating an Accumulate rating and $35 price target on the stock.

KR (+1.5%) announced that they will start to sell clothes from 2018 fall in their grocery stores.

DATA (-9.3%) due to ER miss.

AIG (-4.6%) due to big loss in earnings.

I made no trades today.

Major news: Trump starts his long Asian trip.

Winners

QCOM (+12.7%): Bloomberg reported rumors that Broadcom (AVGO) is exploring a deal to purchase QCOM. Congratulations to those who bought the dip few days ago.AAPL (+2.6%) reported surprising ER beat and bright outlook of iphone X. I would like to share some data and my thoughts. 2018Q1 and Q2 will probably great. P/E is standing @ 19 now. The following chart is the revenue data in the recent years. It took a dip in 2016 and recovered in 2017 --- $234B in 2015, $216B in 2016 and $229B in 2017, which means revenue dropped 2% from 2015 to 2017. On 1/1/2015, stock price was $109, it is $173 today. The huge factor will be iphone sale in China and the innovations beyond iphone X. If they cannot deliver, I believe the revenue will start to shrink again from 2018Q3.

SBUX (+2.1%) stock price dropped more than 7% yesterday after the ER due to the flat revenue and long-term growth rate cut from 15-20% to 12%. Analysts later realized it is one week short compared to last year, which means revenue grows 7% indeed. And 12% growth is not bad at all, on which CEO shows his confidence to achieve.

UAL (+2.4%) beaten-down airlines finally has a good day, no specific news.

GE (+1%) finally stops 9-day bleeding and find the support @ $20. Melius Research's Scott Davis believes GE CEO John Flannery likely will take even more drastic action than previously indicated, including a "spinoff its troubled Power unit and refocus that unit away from growth and more towards annuitized cash generation." Davis thinks GE's renewable business could find a home elsewhere, GECAS will be spun off, and smaller and non-core pieces also will be sold off, including Transportation (locomotives) and the Healthcare IT business. "Essentially what would remain of GE then would be a world-class healthcare asset, which Flannery knows very well, a majority equity stake in BakerHughes, and a world-class aerospace business," Davis writes. Even so, Davis is optimistic about GE in the long term, reiterating an Accumulate rating and $35 price target on the stock.

KR (+1.5%) announced that they will start to sell clothes from 2018 fall in their grocery stores.

Losers

Sears (SHLD -4.8%) will close more stores. Mall stocks fall again, including M (-2.2%), which reaches new multi-year low. M will report earnings next week (11/9) and rumors on the street that it is in talk for sale (which caused the early morning spike on 11/1).DATA (-9.3%) due to ER miss.

AIG (-4.6%) due to big loss in earnings.

I made no trades today.

Comments

Post a Comment