A Look into Fitbit (FIT)

Shortly after its IPO in June 2015, FIT touched $50. Then it fell into a downhill channel.

The original Flex, Charge, Charge HR, Charge 2, Alta and Alta HR were very successful and adopted widely. The Blaze was not a smashing success as it fell short on functions and wasn’t much more than another form of step tracker. Fitbit also came up short and misjudged the market for the Flex 2, which has experienced poor sales.

Here are all the earnings in its history as a public company.

2015 Q2 $0.21 $400M

2015 Q3 $0.24 $409M

2015 Q4 $0.35 $712M

2016 Q1 $0.10 $337M

2016 Q2 $0.12 $587M

2016 Q3 $0.19 $504M

2016 Q4 $-0.56 $574M

2017 Q1 $-0.15 $299M

2017 Q2 $0.00 $353M

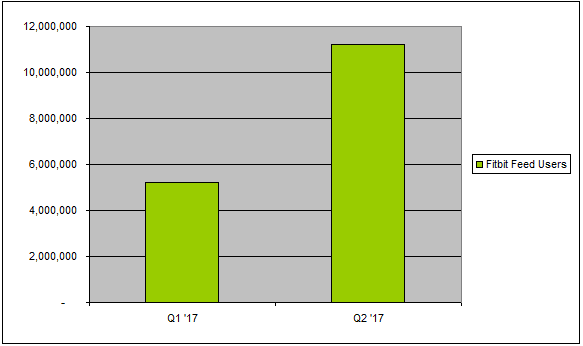

The revenue hit bottom in 2017 Q1. Afterwards, Fitbit made quite some changes --- layoff to reduce costs, launching app and social media, which are well responded. The growth in the Fitbit Community Feed is explosive. Since launching the enhanced Community Feed in March of 2017, the number of people joining groups, reading through the feed and posting is growing rapidly. Its recent acquisitions of Coin, Pebble, and Vector have resulted in the company's first smart watch. Based on the global launch of the Ionic ($300 watch, hit market on 10/1), Flyer ($130 headphones, hit market on 10/1) and Aria 2 (smart scale), FIT is poised to recovery.

Wearables grew 16.9% in 2016 Q4, 17.9% in 2017 Q1 and 10.3% in 2017 Q2 (according to IDC). FIT have certain advantages in the crowded fitness watch space. They have a huge customer base, who have good loyalty to Fitbit. They have wide range of products from high end (Ionic) to low end (fitness trackers).

The high end product Ionic which has a '$300' price tag, competing directly with Apple Watch. "Key distinctions in head-to-head comparison with the Fitbit Ionic product are compatibility with non-iOS devices, longer battery life which supports sleep tracking (claimed 4 days vs. Series 3 watch at 18 hours) and a narrow advantage in price ($299 vs. $329)," writes analyst Jim Duffy. According to reviews on amazon, it is well received. 78% customers rated it 4/5 stars, same as Apple Watch. The healthy profit margin and the upcoming holidays will bring EPS growth again.

FIT will release Q3 ER on 11/1. Currently FIT has market cap of 1.5B. By Q2, they have 319M cash (or cash equivalents), and only 348M liabilities. Recent pullback is a buying opportunity. At current price, I believe that the reward will be higher than risk. I plan to initiate my position around $6.

The original Flex, Charge, Charge HR, Charge 2, Alta and Alta HR were very successful and adopted widely. The Blaze was not a smashing success as it fell short on functions and wasn’t much more than another form of step tracker. Fitbit also came up short and misjudged the market for the Flex 2, which has experienced poor sales.

Here are all the earnings in its history as a public company.

2015 Q2 $0.21 $400M

2015 Q3 $0.24 $409M

2015 Q4 $0.35 $712M

2016 Q1 $0.10 $337M

2016 Q2 $0.12 $587M

2016 Q3 $0.19 $504M

2016 Q4 $-0.56 $574M

2017 Q1 $-0.15 $299M

2017 Q2 $0.00 $353M

The revenue hit bottom in 2017 Q1. Afterwards, Fitbit made quite some changes --- layoff to reduce costs, launching app and social media, which are well responded. The growth in the Fitbit Community Feed is explosive. Since launching the enhanced Community Feed in March of 2017, the number of people joining groups, reading through the feed and posting is growing rapidly. Its recent acquisitions of Coin, Pebble, and Vector have resulted in the company's first smart watch. Based on the global launch of the Ionic ($300 watch, hit market on 10/1), Flyer ($130 headphones, hit market on 10/1) and Aria 2 (smart scale), FIT is poised to recovery.

Wearables grew 16.9% in 2016 Q4, 17.9% in 2017 Q1 and 10.3% in 2017 Q2 (according to IDC). FIT have certain advantages in the crowded fitness watch space. They have a huge customer base, who have good loyalty to Fitbit. They have wide range of products from high end (Ionic) to low end (fitness trackers).

The high end product Ionic which has a '$300' price tag, competing directly with Apple Watch. "Key distinctions in head-to-head comparison with the Fitbit Ionic product are compatibility with non-iOS devices, longer battery life which supports sleep tracking (claimed 4 days vs. Series 3 watch at 18 hours) and a narrow advantage in price ($299 vs. $329)," writes analyst Jim Duffy. According to reviews on amazon, it is well received. 78% customers rated it 4/5 stars, same as Apple Watch. The healthy profit margin and the upcoming holidays will bring EPS growth again.

FIT will release Q3 ER on 11/1. Currently FIT has market cap of 1.5B. By Q2, they have 319M cash (or cash equivalents), and only 348M liabilities. Recent pullback is a buying opportunity. At current price, I believe that the reward will be higher than risk. I plan to initiate my position around $6.

Comments

Post a Comment