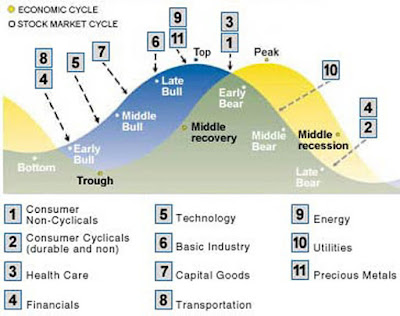

Sector Rotation in the Market

What is Sector Rotation? Sector rotation is an investment strategy. Major players in the market move money from one industry sector to another in an attempt to beat the market. In order to understand sector rotation, we need to study the market cycle and economy cycle. Market Cycle and Economy Cycle Both have 4 stages: bottom, recovery (bull market), top, recession (bear market), which is shown in the following chart. However, market (in blue) usually move ahead of the economy (in yellow) for a few months. Market will reach top when the economy still looks great. However, the interest rate and inflation would be high at that moment. In bull market, investors prefer to rotate into financials/transportation (early bull), technology/capital goods (middle bull), basic industry (late bull). Money rolls into energy and gold/silver at the market top. As the bear market starts, healthcare and non-cyclical become attractive. During the downtrend, utilities would be the only survi...