Market 2018-03-23 (Correction Again? MU, and more)

Dow Jones -1.8%, S&P 500 -2.1%, Nasdaq -2.4%. Dow Jones is very close to Feb low during that correction.

Crude +2.47% to $65.89. Gold +1.42% to $1,346.20 as safe-haven.

Treasury yields almost flat. US dollar drops again, UUP -0.36%.

For the week, Techs -7.6%, Financials -7.1%, Healthcare -6.7%, Industrials -5%; Energy fell only -0.8%.

On News

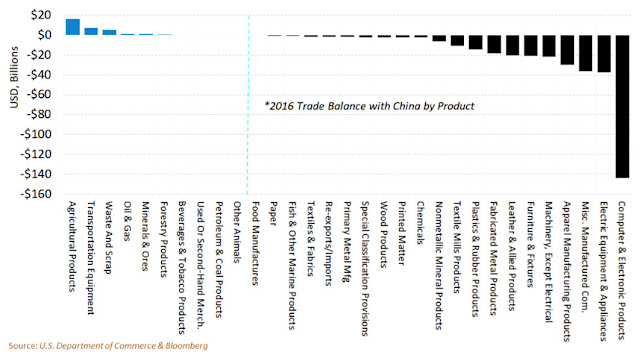

China has listed 128 American products for retaliation. The products had an import value of $3B last year, and include American steel, aluminum, pork, and wine. It is considered mild response. However, more actions may follow.Following chart shows the trades between US and China in 2016, by products.

McMaster is fired. New National Security Adviser John Bolton is a war-monger. He wants wars with Iran and North Korea. He was involved Iraq War. He has worked for Russia before. All these make investors worry a lot!

Trump signs the $1.3T spending bill passed by Congress, hours after threatening to veto it over dissatisfaction with its immigration provisions.

Democratic Republic of Congo’s mining minister rejects a proposal by mining companies to soften some provisions in the country's new mining code in exchange for higher royalties.

Winners

Gold Miners shine, NUGT +8.3%.FL +4.4%, probably helped by Nike ER (NKE +0.3%).

Defense stocks benefit from new spending bill: LMT +2.8%, RTN +2.6%, NOC +2.1%.

YY +2.9% is one of few stocks showing green today.

Losers

Square (SQ -6.3%) was cut to sell as Craig-Hallum's analyst Brad Berning says that competition and challenging comps will hurt revenue growth and the stock.MU -8% is downgraded by Citi from Buy to Neutral following yesterday’s ER. Outlook for DRAM is good, not the case for NAND. Stifel raises its PT from $85 to $95. Mizuho Securities raises its PT by $4 to $70. Cowen raises its PT by $10 to $65 but Marvell (MRVL -2.6%) remains the firm’s top idea.

WDC -8.4%, STX -4.7%, AMAT -6.1%, LRCX -5.7%, NVDA -3.7%.

FAANG: FB -3.3%, AMZN -3.2%, AAPL -2.3%, NFLX -1.9%, GOOG -2.6%.

Box -8% after Dropbox (DBX +35%) IPO.

My Trades Today

Sold 1/3 YY.Added more C.

这个盘很难做。最关键的是trump天天砸盘。典型的不作不死。

ReplyDelete可不是吗,这周全是他砸的,感觉离坐牢不远了

Delete