Wanna Retire Early, Start Planning Now!

It is very important to plan your retirement as early as possible. Why? It is because the money you put into investment will grow fast. If you put $1k into your retirement account at age 20, it will grow into $15k when you reach age 60, assuming 7% annual return rate. As comparison, if you put $1k at age 30, it will only grow into only $7.6k, about half of the former case!

One popular topic these days is to get retired early, for instance, at the age 50. Assuming the average yearly expense (including medical cost) is $100k and you live to age 90, you need at least $4M by age 50. Of course if you plan to get retired at age 60, then the retirement fund will be smaller ($3M). There is a new phrase "Million Dollar Poor" ---- $1M may only support you from age 70 to 80 --- retire @ age 70 and decease @ age 80.

In this article, I would like to introduce the possible stable income sources for retirement. (This is a brief introduction, for more details, please ask your financial adviser or check IRS website.)

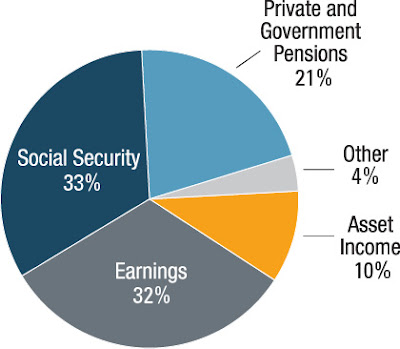

Above is chart represents a breakdown of income sources for all retirees in US (aged 65 and over). Source: Social Security Administration 2016.

1. Social Security

If you pay attention to your W2 form, you may notice Social Security and Medicare terms. The money is deducted from everyone's salary, and used for elders and disables.The current standard retirement age is set @ 67. When you reach this age, you can start to declare your social security benefit. The amount you get is based on the total of the highest 35 years contribution if you have worked for more than 35 years. You may also start to collect as young as 62. However, your monthly paycheck will be much less than normal. As contract, you may delay as late as 70, the paycheck will be fatter. If you are in great health at 67, then it is a smart move to delay for couple of years.

Please keep in mind that the paycheck from social security is not a lot. The maximum is $2,687 per month for a single person and 1.5 times this amount for a married couple in 2017.

2. Pensions

If you work for government or some colleges or companies which give pensions, congratulations! It is a very reliable source for your retirement. As I know, many companies have stopped their pension program to new employees, for instance, Koch Industries from 2016, GE from 2012.3. 401(k) or 403(b), 457(b)

A 401(k) plan is the tax-qualified, defined-contribution pension account. Under the plan, retirement savings contributions are provided (and sometimes proportionately matched) by an employer, deducted from the employee's paycheck before taxation (therefore tax-deferred until withdrawn after retirement or as otherwise permitted by applicable law), and limited to a maximum pre-tax annual contribution of $18,500 (as of 2018). As you will probably be in lower tax bracket when you retire, the benefits of deferring tax are obvious.Similarly, 403(b) is for nonprofit institutions and 457(b) is for governmental employers.

In these plans, you may invest the money in multiple forms (Stocks, ETFs, Mutual funds, Bonds, Money market, and so on). Money that is withdrawn prior to the age of 59½ typically incurs a 10% penalty tax unless a further exception applies.

A Roth 401(k) is an employer-sponsored investment savings account that is funded with after-tax money up to the contribution limit of the plan.

The main difference between a Roth 401(k) and a Traditional 401(k) relates to the taxation of funding and distributions. You pay no tax when contributing to a Traditional 401(k), you pay tax when you withdraw. Alternatively, your contribution to a Roth 401(k) is after-tax money. You pay no tax on both principles and gains when you withdraw so long as you are qualified (>age 59½).

Here is the LINK on IRS website of the updates on 2018 Pension Limitations.

After-tax 401k contribution

If your 401k allows additional contributions the maximum you can contribute including your pretax contributions, your after tax contributions and your employers match is $54,000 (2017).

If your account balance contains both pretax and after-tax amounts, any distribution will generally include a pro rata share of both.

Example: Your account balance is $100,000, consisting of $80,000 in pretax amounts and $20,000 in after-tax amounts. You request a distribution of $50,000. Your distribution consists of $40,000 pretax and $10,000 after-tax.

Can I roll over just the after-tax amounts in my retirement plan to a Roth IRA and leave the remainder in the plan?

No, you can’t take a distribution of only the after-tax amounts and leave the rest in the plan. Any partial distribution from the plan must include some of the pretax amounts. Notice 2014-54 doesn’t change the requirement that each plan distribution must include a proportional share of the pretax and after-tax amounts in the account. To roll over all of your after-tax contributions to a Roth IRA, you could take a full distribution (all pretax and after-tax amounts), and directly roll over:

- pretax amounts to a traditional IRA or another eligible retirement plan, and

- after-tax amounts to a Roth IRA.

Here is the LINK of an article with more details.

4. IRA and Roth IRA

IRA stands for individual retirement account. You may start to withdraw from age 59½.IRA (Traditional IRA): contributions are often tax-deductible, and withdrawals at retirement are taxed as income, which is similar to 401(k).

Roth IRA: contributions are made with after-tax assets, and withdrawals are usually tax-free, which is similar to Roth 401(k).

Total annual contributions to your Traditional and Roth IRAs combined cannot exceed: $5,500 (under age 50) $6,500 (age 50 or older) as of 2017/2018.

There are income limitations for IRA contributions (2018):

- For single taxpayers covered by a workplace retirement plan, the phase-out range is $63,000 to $73,000, up from $62,000 to $72,000.

- For married couples filing jointly, where the spouse making the IRA contribution is covered by a workplace retirement plan, the phase-out range is $101,000 to $121,000, up from $99,000 to $119,000.

- For an IRA contributor who is not covered by a workplace retirement plan and is married to someone who is covered, the deduction is phased out if the couple’s income is between $189,000 and $199,000, up from $186,000 and $196,000.

- For a married individual filing a separate return who is covered by a workplace retirement plan, the phase-out range is not subject to an annual cost-of-living adjustment and remains $0 to $10,000.

The income phase-out range for taxpayers making contributions to a Roth IRA is $120,000 to $135,000 for singles and heads of household, up from $118,000 to $133,000. For married couples filing jointly, the income phase-out range is $189,000 to $199,000, up from $186,000 to $196,000.

Currently, anyone can convert money in a Traditional IRA to a Roth IRA, no matter how much annual income they earn. However, You will need to pay taxes on any money in your Traditional IRA that hasn’t already been taxed. The funds that you convert to a Roth IRA will most likely count as income, which could kick you into a higher tax bracket in the year you do the conversion. On the other hand, if your income happens to be unusually low in a particular year (for instance, you have a gap in employment), you could take advantage of that situation by making the Roth conversion then. Timing is important.

Compare to your cash account investment, Roth 401k and Roth IRA have the advantage that you can avoid tax on your gains. Also you don't need to care about short-term gain or capital gain in Roth accounts. The disadvantage is less flexibility that you have to wait until age 59½ to withdraw.

5. Other Investment

Real Estate (rental income): rental income is relatively stable, especially in large cities. You may hire property managing company to run your rental apartments to avoid lots of troubles. Umbrella insurance is highly suggested.Fixed income: dividends, either monthly or quarterly, from blue-chip companies, utilities, telecomm companites, REIT/mREIT and some mutual funds are quite stable, for instance, KO, MO, BA, AMGN, MCD, WM, T, O, AGNC, et al. Investing $1M with 4% dividend means 40k stable annual income. HERE is My Artcile which explain dividend and dividend growth strategy.

6. Anuity

An annuity is an insurance product that pays out steady income later. Annuities can be structured generally as either fixed or variable. Fixed annuities provide regular periodic payments to the annuitant. Variable annuities allow the owner to receive greater future cash flows if investments of the annuity fund do well and smaller payments if its investments do poorly. This provides for a less stable cash flow than a fixed annuity, but allows the annuitant to reap the benefits of strong returns from their fund's investments.One criticism of annuities is that they are illiquid. Deposits into annuity contracts are typically locked up for a period of time, known as the surrender period, where the annuitant would incur a penalty if all or part of that money were touched.

Annuities are appropriate financial products for individuals seeking stable, guaranteed retirement income. Because the lump sum put into the annuity is illiquid and subject to withdrawal penalties, it is not recommended for younger individuals or for those with liquidity needs (for instance, buying a house). Annuity holders cannot outlive their income stream, which hedges longevity risk. So long as the purchaser understands that he or she is trading a liquid lump sum for a guaranteed series of cash flows, the product is appropriate.

Good. I want to know how to invest to the new business. If you know tell me or have another post like https://www.reportingaccounts.com/, plz share with me.

ReplyDeleteThank you

I completely agree that if one wants to retire early, he should start planning early. I am pleased with these wonderful tips because these have given me goals to start saving money from this time. It is hard to find right options on my own and that’s why considering hiring a certified financial planner india for that.

ReplyDeleteI am a certified, reputable, legitimate and accredited money lender. I loan money out to people in need of financial assistance. Do you have a bad credit or you are in need of money to pay bills? I want to use this medium to inform you that we provide reliable beneficiary assistance as we will be glad to offer you a cash email: globalcreditts@gmail.com

ReplyDelete