2018-03-22 ("mad world", Chinese Retaliation, and more)

Crude -1.44% to $64.23. Gold +0.52% to $1,328.40.

Treasury yields drop as money flows from stocks to bonds, TLT +1%.

US Dollar flat, UUP +0.14%.

As I said yesterday, "it could be ugly" on Thursday due to tariffs on Chinese goods. It is indeed, worst than I expected. We live in a "mad world" with probably the stupidest government in US history. First of all, let's review what it is.

|

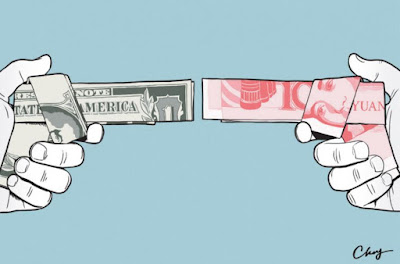

| Picture from internet |

Tariffs on $50B-plus Chinese Imports

The Trump administration is imposing tariffs on $50B of Chinese goods imports, the first shot in what could become a contentious global trade war."This is the first of many," Trump says.

"It could be about $60B," Trump says, but "that's really just a fraction of what we're talking about." A 30-day comment period from business could have an effect on the ultimate figure. He's asking China to immediately reduce the trade surplus by $100B.

"I view them as a friend; I have great respect for President Xi," Trump says. But we have a trade deficit of $504B, depending on how you calculate it, he adds.

With the U.S. importing about $500B in goods from China annually, $50B is about 10% of items the U.S. buys.

China has said it was prepared to retaliate with "necessary measures."

The U.S. has a preliminary list of more than 1,000 products that can be targeted, and will also look to bring licensing complaints to the World Trade Organization.

What's Next?

China doesn't want Trade War. However, they must fight back. I am not expecting furious counter-tariffs right now. China government will probably take a soft approach. It must start with soybean and other agricultural products. Meanwhile, China will depreciate its currency against US Dollar to absorb the tariffs loss. Afterwards, the situation will depend on the outcome of negotiation, which can go either way --- back to uptrend channel if both cool down, or trade war & recession.Other News

The House passed 1.3T spending bill. Another government shutdown due this weekend can be avoided if the bill is passed by tomorrow.Trump attorney John Dowd resigns, who was handling special counsel Robert Mueller's investigation. White House Chaos continues.

An analysis of Bitcoin blockchain has revealed it is used for illegal child pornography. Bitcoin could be baned everywhere soon. We shouldn't be surprised as the "Silk Road Saga" happened 4 years ago in 2014. A San Francisco man was arrested in public library, who operated the dark Web online "Silk Road" that generated $8 million in monthly sales by using bitcoins and attracted 150,000 vendors and customers, along with other illegal activities.

Toys R Us has Liquidation Sale Starts Today, till end of June.

Winners

Utilities (XLU +0.44%) becomes safe-haven.P +7.9% after a two-notch upgrade at Raymond James, to Strong Buy.

Losers

Abbvie (ABBV -12.8%) backs away from pursuing accelerated approval for Rova-T after disappointing mid-stage data in third-line lung cancer.CAT -5.8%, BA -5.2%, MMM -4.8% are the worst in Dow 30.

Tencent Holdings Ltd (TCEHY -10.7%) as major investor unloads shares worth $10.6B. Shares enter correction. BIDU -5.6%, NTES -5.4%, WB -7%, SINA -6.8%, BABA -5.5%, JD -2.3%, YY -6.5%, MOMO -2.3%, QD -5.2%, YRD -8.3%...

ER in AH

Micron Technology (MU -3.5%): Q2 EPS of $2.82 beats by $0.08. Revenue of $7.35B (+58.1% Y/Y) beats by $70M. Shares recovered from -7%, now -0.5%.Nike (NKE -2.9%): Q3 EPS of $0.68 vs consensus $0.53. Revenue of $8.99B (+6.6% Y/Y) beats by $140M. Shares +2.2% in AH.

My Trades Today

Sold BGS @ $26.6Bought YY @ $118 (as I sold all shares on Tuesday and Wednesday)

Added FB @ $165 (as I sold half position yesterday)

Added CMCSA

Added C

玩具店的创始人今天去世了。中国人说了,贸易战开始先砸trump的基本盘,什么州最支持他,就先集中力量砸那些voters。trump是不作不死的典型。

ReplyDelete听说玩具店的好东西都走的差不多了。清仓特价开始估计也不剩什么了。上礼拜在他家买的东西到现在没寄出来。哎。

DeleteBGS looks at the bottom.

ReplyDeleteYes, I sold my shares for small gain ($26 --> $26.6) because I am out of cash to buy Citibank

DeleteChina has listed 128 American products for retaliation. The products had an import value of $3B last year, and include American steel, aluminum, pork, and wine.

ReplyDeleteThis comment has been removed by the author.

DeleteI suspect whether China and US will really retaliate each other... Trump has big mouth. However, I do think FB has serious problems... there might be a new low tomorrow.

Delete