Sector Rotation in the Market

What is Sector Rotation?

Sector rotation is an investment strategy. Major players in the market move money from one industry sector to another in an attempt to beat the market. In order to understand sector rotation, we need to study the market cycle and economy cycle.Market Cycle and Economy Cycle

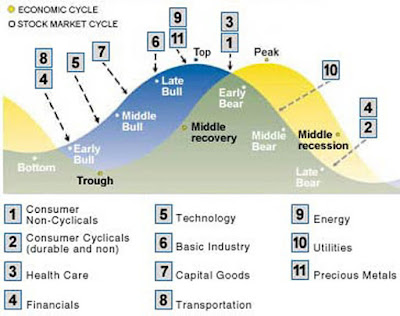

Both have 4 stages: bottom, recovery (bull market), top, recession (bear market), which is shown in the following chart. However, market (in blue) usually move ahead of the economy (in yellow) for a few months. Market will reach top when the economy still looks great. However, the interest rate and inflation would be high at that moment.In bull market, investors prefer to rotate into financials/transportation (early bull), technology/capital goods (middle bull), basic industry (late bull). Money rolls into energy and gold/silver at the market top. As the bear market starts, healthcare and non-cyclical become attractive. During the downtrend, utilities would be the only survivors.

Bottom Line

The model above provides some guidance for investment strategy. However, it is not perfect. The market changes quickly and unpredictably. For instance, because of QE, interest rate stays low for quite long time during recovery --- which is considered historically low now. Another example is that energy price has been low for several years due to shale boom and OPEC slow actions, which makes it easy to control inflation.Each industry has their own cycles. Supply-demand relationship dominates in these cycles. Let's take a look of flash memory industry, e.g. MU. Stock price was below $5.5 at the end of 2012. Two years later, it reached $36.5, +560% in 2 years. That was in middle-bull period. Then Samsung put the price pressure on memory market and PC market was down, MU dropped to $9.5 in May 2016 (Market cap shrunk to only 26%). Suddenly it jumped to bull market again --- finished @ $44.3 today, all-time high.

Comments

Post a Comment